Our Comprehensive Guide to FinOps for Cloud Computing

By

Rohit Sharma

—

min read

In today's cloud-driven world, organizations are rapidly embracing the agility, scalability, and innovation that cloud computing offers. However, this shift towards the cloud has also introduced new challenges, particularly in the realm of cost management. As cloud adoption accelerates, organizations often find themselves grappling with uncontrolled spending, lack of visibility, and difficulty in aligning cloud investments with business objectives.

Enter FinOps, a cloud financial management discipline that empowers organizations to take control of their cloud costs while maximizing the value derived from their cloud investments. FinOps is a cultural shift that fosters collaboration between finance, engineering, and business teams, breaking down silos and promoting a shared understanding of cloud economics.

At its core, FinOps is about transparency, accountability, and data-driven decision-making. By implementing FinOps practices, organizations gain granular visibility into their cloud spending, enabling them to identify cost drivers, optimize resource utilization, and align cloud investments with their business goals. This approach not only drives cost savings but also ensures that cloud resources are allocated efficiently, supporting strategic initiatives and fueling innovation.

However, embarking on a FinOps journey can be daunting, especially for organizations grappling with complex, multi-cloud environments and diverse business requirements. That's where this comprehensive guide comes in. Tailored specifically for Arche AI's customers, this guide offers actionable insights and best practices for implementing a successful FinOps strategy within your organization.

From establishing a FinOps culture and building a dedicated team to leveraging advanced tools and automation, this guide will walk you through every step of the FinOps journey. You'll discover how to conduct comprehensive assessments, develop tailored strategies, and continuously optimize your cloud costs while aligning with your business objectives.

Whether you're a seasoned cloud practitioner or just starting your cloud journey, this guide will equip you with the knowledge and tools you need to unlock the full potential of FinOps and drive tangible business value from your cloud investments.

Understanding FinOps: Principles, Benefits and Roles

The Principles

Cloud is getting expensive, and managing costs is a headache for teams. And many teams fail to see the gains of their cloud investments.

To deal with these rising costs, we have a few principles that help you with cloud financial management best practices. These principles focus on collaboration, shared ownership, centralized teams, accessible reporting, and driving business value.

FinOps changes the culture of an organization. It promotes collaboration between teams that have traditionally operated in silos. Thanks to cloud infrastructure, different teams within an organization can now work together. Because they are collaborating, they can focus their efforts on achieving common goals for their organization.

One of the most important principles of FinOps is to have a centralized team that drives FinOps initiatives. This team will overlook everything. They'll help the stakeholders across the organization to take ownership of their cloud usage and costs.

They promote accessible and timely reporting and empower teams with insights. With these insights, they can make data-driven decisions to maximize the value of their cloud investments.

FinOps is about shifting the focus from individual features or technologies to the tangible business value they deliver. That's why we encourage organizations to embrace the variable cost model of the cloud. That way, they can continuously optimize their usage and resources to align with their evolving business needs.

Let's move on to the benefits.

Benefits

When teams adopt FinOps practices, they expect some benefits. They can range from cost savings and better visibility to higher operational efficiency and agility. With FinOps, businesses can gain better control over their cloud spending. It enables them to optimize costs and eliminate waste.

FinOps provides organizations with a complete understanding of their cloud usage and costs. Because they have this information, they can work on better resource allocation and prioritization. Accountability and transparency across the organization are the by-products of FinOps.

You can also expect streamlined processes and workflows because of FinOps. That'll boost operational efficiency by automating routine tasks and promoting best practices for cloud resource management.

FinOps also helps you free up valuable resources and bandwidth. That way, your organization can work on strategies and innovations that drive business growth.

Most significantly, FinOps helps organizations maximize the business value of their cloud investments. By aligning cloud usage with business objectives and continuously optimizing resources, you can ensure that your cloud spending yields tangible outcomes - enhanced customer experiences, faster time-to-market, and increased competitiveness.

FinOps Team Structure and Roles

To implement FinOps effectively, many stakeholders in the organization need to collaborate. Top-level executives play a major role in driving cloud financial management initiatives.

At the executive level, C-level leaders are vital as they are responsible for accountability and transparency. They ensure the teams operate efficiently and stay within budget constraints.

Finance teams use the reporting and insights provided by FinOps practitioners for cost allocation, showback/chargeback processes, and accurate forecasting. They collaborate with FinOps teams to understand billing data and develop robust financial models.

Engineering and operations teams build and support the organization's services and applications. They track cloud costs as a key metric and work towards efficient resource utilization. They also implement the best practices for cost optimization.

Roles such as directors of cloud optimization or cloud analysts align product decisions with business outcomes. They predict the impact of cloud infrastructure on product pricing using FinOps insights. They also guide the teams to make useful cloud investments.

To implement FinOps effectively, you need seamless collaboration and alignment among these stakeholders. Promote cross-functional partnerships and establish clear lines of communication. That way, your organization will unlock the full potential of FinOps and maximize its value.

Now that we've understood FinOps basics, let's move ahead.

Steps to Launch a FinOps Initiative

Implementing FinOps in your organization is a long process. It involves a lot of people and teams and requires careful planning and execution.

First, assess

The first step is to know where you currently stand regarding cloud usage, costs, and challenges. Conduct a comprehensive assessment to identify areas of improvement and establish a baseline for measuring progress.

Imagine you're embarking on a road trip without a map or destination in mind. You'd most probably end up lost and waste precious time and resources. A FinOps assessment is your compass, providing visibility into your cloud environment and helping you chart the right course.

During the assessment, you'll analyze your cloud infrastructure, applications, and workloads to understand resource utilization, cost drivers, and potential waste areas. This process will involve tools for monitoring, reporting, and cost analysis. Also, ask for inputß from stakeholders across different teams.

With a clear picture of your current state, you can start building a dedicated FinOps team. This team will drive the FinOps initiative. It'll bring representatives from finance, engineering, operations, and other relevant departments together. Clearly define their roles and responsibilities to ensure accountability and avoid silos.

Then, develop a FinOps strategy

A one-size-fits-all approach to FinOps is unlikely to succeed. Tailor your FinOps strategy to your organization's unique needs, size, industry, and business objectives. It's a custom-fitted suit.

For small businesses, FinOps implementation may seem daunting initially. But the benefits are significant. Small teams can achieve better financial control and operational efficiency by optimizing cloud costs.

The ultimate goal is to maximize the value derived from your cloud investments while minimizing waste and unnecessary spending.

Imagine you're running a successful e-commerce business with ambitious growth plans. Your FinOps strategy will ensure rapid scaling of your cloud infrastructure to handle traffic spikes during peak sales periods while optimizing costs during quieter times.

On the other hand, if you're a healthcare provider, your FinOps strategy may prioritize data security, compliance, and business continuity, ensuring your cloud environment meets the strict regulatory requirements while providing reliable access to critical applications and patient data.

By tailoring your FinOps strategy to your unique needs and aligning it with your business goals, you can unlock the true potential of FinOps and drive tangible results for your organization.

Follow the best practices

While implementing FinOps, you need to improve and adapt constantly. As your cloud usage and business needs evolve, your FinOps practices should evolve.

As you begin your FinOps initiatives, some tried-and-true best practices can help ensure a successful FinOps implementation.

We've already established the importance of a culture of collaboration and shared responsibility. FinOps is a combined effort. The stakeholders must participate and be on the same page. Encourage open communication and data sharing, and ensure everyone understands the FinOps principles and goals.

Another best practice is to start small and scale gradually. Rather than attempting to overhaul your entire cloud environment overnight, begin with a pilot project or a specific workload. This approach allows you to test your FinOps strategies, learn from mistakes, and refine your processes before expanding to large-scale plans.

Automate repetitive tasks. Use tools and scripts to automate resource provisioning, decommissioning, and policy enforcement. You can reduce the risk of human error, improve efficiency, and free up valuable time for more strategic activities.

Regularly reviewing and optimizing your cloud usage is crucial. As your business needs change, you may find that some resources are underutilized or no longer necessary. Continuously monitor, adjust, and decommission the resources you don't need and save.

Challenges and pitfalls are inevitable, no matter how fool-proof your FinOps journey might be. Common challenges include resistance to change, siloed data and processes, or difficulty in accurately attributing costs to specific business units or projects.

Anticipating and proactively addressing these challenges can help you implement FinOps smoothly. As new technologies and best practices emerge, reevaluate and refine your FinOps strategies.

Regularly review your processes, celebrate successes, and learn from setbacks – this mindset will help you stay ahead of the curve and maximize the value of your cloud investments over time.

FinOps tools and their importance

What are FinOps tools?

You need proper tools to implement your FinOps strategies effectively. The market is filled with a wide range of tools and solutions. They are designed to assist you with various aspects of cloud financial management, from cost monitoring and reporting to optimization and automation.

Most FinOps tools provide cost visibility and reporting capabilities. They allow you to track your cloud spending, identify cost drivers, and generate insights for better decision-making.

As your FinOps initiatives grow, you'll need more advanced tools that offer features such as cost allocation, budgeting, and showback/chargeback functionality.

Optimization tools are another critical component of a FinOps toolkit. These solutions analyze your cloud environment, identify inefficiencies and waste, and recommend you for rightsizing resources or implementing cost-saving measures. Some tools even offer automated optimization capabilities.

Automation tools are becoming essential for FinOps teams rapidly. They allow teams to automate resource provisioning, decommissioning, and policy enforcement. They reduce manual effort and minimize human error, improving operational efficiency and cost management.

When selecting FinOps tools, it's crucial to consider your organization's specific requirements, existing tech stack, and integrations needed with other systems. A tool that excels in one area may fall short in others, so carefully evaluating your options is essential to ensure you have the right tools for your FinOps journey.

How do top FinOps tools compare?

The FinOps tools market is rapidly evolving, with new players and solutions emerging regularly. While a comprehensive comparison of all available tools can be a separate guide, let's explore some popular options, their strengths, and limitations.

Cloud provider-native tools like AWS Cost Explorer, Azure Cost Management, and Google Cloud Billing, offer basic cost monitoring and reporting capabilities. These tools are often user-friendly and seamlessly integrated with the respective cloud provider's ecosystem. They may lack advanced features like cost allocation, optimization recommendations, and multi-cloud support.

Third-party FinOps tools like CloudHealth, Cloudability, and Apptio Cloudlgenius provide more comprehensive cloud financial management capabilities. These tools offer cost reporting, showback/chargeback functionality, and optimization recommendations across multiple cloud providers. On the flip side, they can be more expensive and may require additional integration efforts.

Open-source solutions like Kubecost, Finops.co, and Cloud Custodian offer cost monitoring and optimization capabilities at no licensing cost. While these tools can be highly customizable, they require more technical expertise to set up and maintain. They may lack some of the advanced features found in commercial offerings.

When evaluating FinOps tools, consider factors such as ease of use, integration capabilities, scalability, and the level of support.

For organizations with complex multi-cloud environments or specific compliance requirements, tools like Cloudability or Apptio Cloudlgenius may be more suitable, offering advanced features and enterprise-grade support.

Smaller organizations or those with more straightforward cloud environments can use cloud provider-native tools or open-source solutions like Kubecost or Finops.co.

Why should you integrate these tools into FinOps practices?

Installing FinOps tools is just the first step. Proper tool configuration and data integration ensure accurate and reliable information flows between your FinOps tools and other systems.

Start by mapping your existing processes and identifying potential integration points for your FinOps tools. It involves integrating them with your cloud provider's billing and usage data and other systems like project management tools, ticketing systems, or financial applications.

Once the integrations are in place, establish clear processes and workflows for using the FinOps tools. It includes defining roles and responsibilities, setting up automated reporting and alerts, and establishing governance policies to manage and optimize costs.

Train all the users. Ensure that all relevant stakeholders, including finance, engineering, and business teams, are trained to use the FinOps tools effectively and interpret the data and insights they provide.

Continuously monitor and refine your FinOps tool integrations. As your cloud environment evolves and you introduce new tools or processes, prepare to adapt and optimize your FinOps tools accordingly.

By following best practices for tool integration, proper configuration, and user training, you can maximize the value derived from your FinOps tools and ensure they seamlessly support your organization's cloud financial management initiatives.

Advanced FinOps strategies

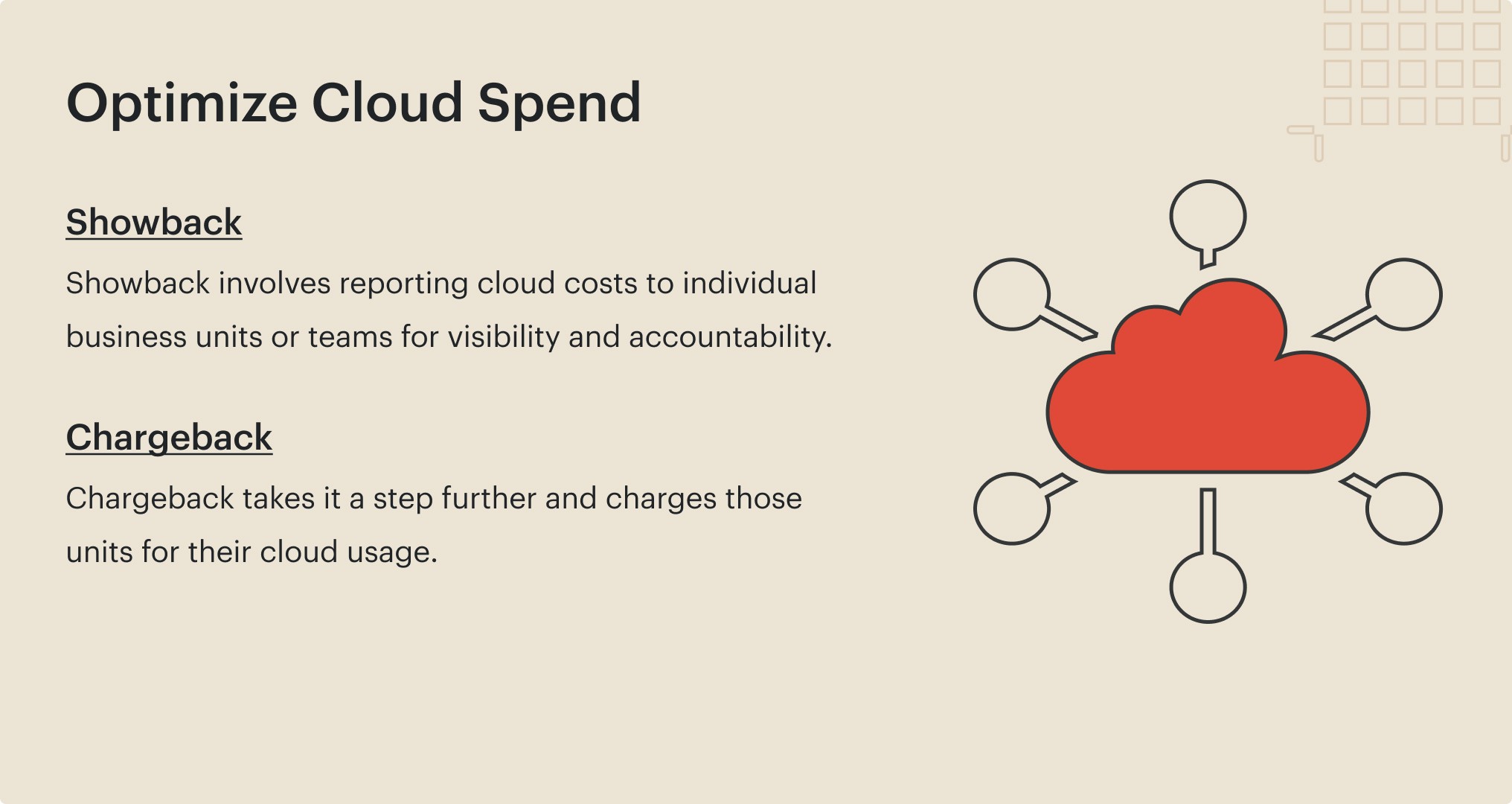

Optimize cloud spend with FinOps

Your FinOps practices will mature with time. Here's when you deploy advanced strategies to optimize cloud spend and resource allocation. These strategies are more than just cost monitoring and reporting. They help you proactively manage your cloud investments. So you can align them better with your business objectives.

One technique is cost attribution. It accurately allocates cloud costs to specific business units, projects, or applications. It provides you granular visibility into where your cloud spend is going. This way, you can better manage resource allocation and prioritization.

Cost attribution is highly valuable for organizations with complex, multi-cloud environments or those operating in a shared services model.

Another strategy is showback or chargeback models. Showback involves reporting cloud costs to individual business units or teams for visibility and accountability. And chargeback takes it a step further. It charges those units for their cloud usage.

These models create a culture of cost awareness. They push for more responsible cloud resource consumption across the organization.

Closely monitor the business value delivered by your cloud investments. You can make informed decisions about where to allocate resources and where to optimize or decommission underutilized or non-essential workloads.

We already looked at an example previously.

Take advantage of automation

Automation is a powerful enabler of FinOps success, allowing organizations to streamline processes, reduce human error, and make real-time decisions based on accurate, up-to-date data. By embracing automation in your FinOps practices, you can unlock new levels of efficiency and cost optimization.

One key area where automation can have a significant impact is cost anomaly detection. By continuously monitoring your cloud usage and cost patterns, automated systems can quickly identify and alert you to any unusual spikes or deviations from expected norms. This early detection can help you quickly investigate and mitigate potential cost overruns before they spiral out of control.

Resource provisioning and de-provisioning are also prime candidates for automation in FinOps. By leveraging automation tools and scripts, you can automatically provision or scale cloud resources based on predefined policies and triggers, such as changes in demand or utilization levels. This can help ensure that you're only paying for the resources you need, eliminating waste and optimizing costs.

Policy enforcement is another area where automation can be invaluable. By codifying your cloud governance policies and automating their enforcement, you can ensure consistent adherence to best practices across your organization. This could include automatically terminating unused or non-compliant resources, enforcing security and compliance standards, or implementing cost-saving measures like scheduling resource stop/start times.

Beyond these specific use cases, automation can bring broader benefits to your FinOps practice, such as improved efficiency, reduced human error, and faster decision-making cycles. By automating repetitive tasks and leveraging real-time data, your FinOps team can focus their efforts on higher-value activities, such as strategic planning, optimization, and driving business value.

However, it's important to approach automation in a thoughtful and controlled manner. Clearly defined policies, robust testing, and careful monitoring are essential to ensure that your automated processes are functioning as intended and not introducing unintended consequences or risks.

FinOps and its applications in different industries

The core principles of FinOps remain the same. But, the specific approaches and priorities differ across industries. Understanding these nuances will impact your FinOps practices to meet your unique needs and challenges.

For healthcare, regulatory compliance and data security are the top priority. Healthcare organizations' cloud environments must meet strict regulations like HIPAA. They should also maintain the highest levels of data protection for sensitive patient information. FinOps practices in this industry will focus on automating compliance checks, implementing robust access controls, and optimizing costs without compromising security or availability.

For e-commerce businesses, scalability and agility are the priority. During peak shopping seasons, these organizations need to rapidly provision and scale cloud resources to handle spikes in traffic. FinOps strategies for this sector will involve auto-scaling policies and rightsizing resources based on demand patterns. It'll also include deploying serverless or containerized architectures for maximum flexibility.

In the finance sector, data integrity and business continuity are critical. Financial institutions want their cloud environments to be highly available, resilient, and capable of processing transactions with utmost accuracy and reliability. FinOps practices in this industry will prioritize disaster recovery planning, implementing multi-region redundancy, and optimizing costs while maintaining strict service level agreements (SLAs).

Manufacturing companies, on the other hand, focus on integrating their cloud environments with industrial systems, such as Internet of Things (IoT) devices and operational technology (OT) networks. So, they can have cost allocation models that allocate cloud costs to specific production lines or facilities and implement edge computing architectures to reduce data transfer costs.

No matter what the industry is, an effective FinOps strategy requires a deep understanding of the sector's unique challenges, regulatory landscape, and business objectives.

By tailoring your FinOps practices to these considerations, you can unlock the full potential of cloud cost optimization while ensuring compliance, security, and alignment with your industry-specific goals.

FinOps is critical for organizations wanting to optimize their cloud costs, enhance visibility, and maximize the business value of their cloud investments.

As cloud adoption continues to accelerate, the importance of FinOps will only grow. By starting your FinOps journey today and embedding these practices into your organization, you can stay ahead of the curve and position yourself for long-term success in the ever-evolving cloud landscape.

Ready to embark on your FinOps journey? Arche is here to help.

Book a personalized FinOps consultation with our experts today. Our team will work closely with you to understand your unique requirements, assess your current cloud environment, and develop a tailored FinOps strategy that aligns with your business goals and drives tangible results.

Don't let cloud costs hold your organization back. Contact Arche AI and unlock the full potential of FinOps.

Written by

Rohit Sharma

Cloud Practices Head

Pioneer cloud wayfinder Rohit captains enterprise transformations, architecting accelerated futures through landmark migratory voyages plotted for industry titans. His prowess in manifesting bespoke solutions and commitment to insurance and banking partners stretches back years, navigating the cosmos’ shifts as Microsoft’s emissary. Cognizant hallmarks, VMWare certifications, and acclaimed IT transformations now guide the path to grander horizons at Netcon.

BLOGS

Data Center

Mastering Data Center Management with Expert Consulting

Aug 14, 2024

—

13 min read

Data Center

Engaging with Data Center Consultants for Optimal Solutions

Aug 14, 2024

—

12 min read

Data Center

Introduction to Data Center Certifications: An Overview

Aug 14, 2024

—

14 min read

Data Center

Mastering Data Center Operations with Advanced Certifications

Aug 14, 2024

—

12 min read

Ready to take your company to the next level?

Transformation starts here, talk to our experts

© Copyright 2024 Arche AI Pvt. Ltd.

Ready to take your company to the next level?

Transformation starts here, talk to our experts

© Copyright 2024 Arche AI Pvt. Ltd.

Ready to take your company to the next level?

Transformation starts here, talk to our experts

© Copyright 2024 Arche AI Pvt. Ltd.

Ready to take your company to the next level?

Transformation starts here, talk to our experts

© Copyright 2024 Arche AI Pvt. Ltd.

BLOG

Our Comprehensive Guide to FinOps for Cloud Computing

BY

Rohit Sharma

—

13

min read

In today's cloud-driven world, organizations are rapidly embracing the agility, scalability, and innovation that cloud computing offers. However, this shift towards the cloud has also introduced new challenges, particularly in the realm of cost management. As cloud adoption accelerates, organizations often find themselves grappling with uncontrolled spending, lack of visibility, and difficulty in aligning cloud investments with business objectives.

Enter FinOps, a cloud financial management discipline that empowers organizations to take control of their cloud costs while maximizing the value derived from their cloud investments. FinOps is a cultural shift that fosters collaboration between finance, engineering, and business teams, breaking down silos and promoting a shared understanding of cloud economics.

At its core, FinOps is about transparency, accountability, and data-driven decision-making. By implementing FinOps practices, organizations gain granular visibility into their cloud spending, enabling them to identify cost drivers, optimize resource utilization, and align cloud investments with their business goals. This approach not only drives cost savings but also ensures that cloud resources are allocated efficiently, supporting strategic initiatives and fueling innovation.

However, embarking on a FinOps journey can be daunting, especially for organizations grappling with complex, multi-cloud environments and diverse business requirements. That's where this comprehensive guide comes in. Tailored specifically for Arche AI's customers, this guide offers actionable insights and best practices for implementing a successful FinOps strategy within your organization.

From establishing a FinOps culture and building a dedicated team to leveraging advanced tools and automation, this guide will walk you through every step of the FinOps journey. You'll discover how to conduct comprehensive assessments, develop tailored strategies, and continuously optimize your cloud costs while aligning with your business objectives.

Whether you're a seasoned cloud practitioner or just starting your cloud journey, this guide will equip you with the knowledge and tools you need to unlock the full potential of FinOps and drive tangible business value from your cloud investments.

Understanding FinOps: Principles, Benefits and Roles

The Principles

Cloud is getting expensive, and managing costs is a headache for teams. And many teams fail to see the gains of their cloud investments.

To deal with these rising costs, we have a few principles that help you with cloud financial management best practices. These principles focus on collaboration, shared ownership, centralized teams, accessible reporting, and driving business value.

FinOps changes the culture of an organization. It promotes collaboration between teams that have traditionally operated in silos. Thanks to cloud infrastructure, different teams within an organization can now work together. Because they are collaborating, they can focus their efforts on achieving common goals for their organization.

One of the most important principles of FinOps is to have a centralized team that drives FinOps initiatives. This team will overlook everything. They'll help the stakeholders across the organization to take ownership of their cloud usage and costs.

They promote accessible and timely reporting and empower teams with insights. With these insights, they can make data-driven decisions to maximize the value of their cloud investments.

FinOps is about shifting the focus from individual features or technologies to the tangible business value they deliver. That's why we encourage organizations to embrace the variable cost model of the cloud. That way, they can continuously optimize their usage and resources to align with their evolving business needs.

Let's move on to the benefits.

Benefits

When teams adopt FinOps practices, they expect some benefits. They can range from cost savings and better visibility to higher operational efficiency and agility. With FinOps, businesses can gain better control over their cloud spending. It enables them to optimize costs and eliminate waste.

FinOps provides organizations with a complete understanding of their cloud usage and costs. Because they have this information, they can work on better resource allocation and prioritization. Accountability and transparency across the organization are the by-products of FinOps.

You can also expect streamlined processes and workflows because of FinOps. That'll boost operational efficiency by automating routine tasks and promoting best practices for cloud resource management.

FinOps also helps you free up valuable resources and bandwidth. That way, your organization can work on strategies and innovations that drive business growth.

Most significantly, FinOps helps organizations maximize the business value of their cloud investments. By aligning cloud usage with business objectives and continuously optimizing resources, you can ensure that your cloud spending yields tangible outcomes - enhanced customer experiences, faster time-to-market, and increased competitiveness.

FinOps Team Structure and Roles

To implement FinOps effectively, many stakeholders in the organization need to collaborate. Top-level executives play a major role in driving cloud financial management initiatives.

At the executive level, C-level leaders are vital as they are responsible for accountability and transparency. They ensure the teams operate efficiently and stay within budget constraints.

Finance teams use the reporting and insights provided by FinOps practitioners for cost allocation, showback/chargeback processes, and accurate forecasting. They collaborate with FinOps teams to understand billing data and develop robust financial models.

Engineering and operations teams build and support the organization's services and applications. They track cloud costs as a key metric and work towards efficient resource utilization. They also implement the best practices for cost optimization.

Roles such as directors of cloud optimization or cloud analysts align product decisions with business outcomes. They predict the impact of cloud infrastructure on product pricing using FinOps insights. They also guide the teams to make useful cloud investments.

To implement FinOps effectively, you need seamless collaboration and alignment among these stakeholders. Promote cross-functional partnerships and establish clear lines of communication. That way, your organization will unlock the full potential of FinOps and maximize its value.

Now that we've understood FinOps basics, let's move ahead.

Steps to Launch a FinOps Initiative

Implementing FinOps in your organization is a long process. It involves a lot of people and teams and requires careful planning and execution.

First, assess

The first step is to know where you currently stand regarding cloud usage, costs, and challenges. Conduct a comprehensive assessment to identify areas of improvement and establish a baseline for measuring progress.

Imagine you're embarking on a road trip without a map or destination in mind. You'd most probably end up lost and waste precious time and resources. A FinOps assessment is your compass, providing visibility into your cloud environment and helping you chart the right course.

During the assessment, you'll analyze your cloud infrastructure, applications, and workloads to understand resource utilization, cost drivers, and potential waste areas. This process will involve tools for monitoring, reporting, and cost analysis. Also, ask for inputß from stakeholders across different teams.

With a clear picture of your current state, you can start building a dedicated FinOps team. This team will drive the FinOps initiative. It'll bring representatives from finance, engineering, operations, and other relevant departments together. Clearly define their roles and responsibilities to ensure accountability and avoid silos.

Then, develop a FinOps strategy

A one-size-fits-all approach to FinOps is unlikely to succeed. Tailor your FinOps strategy to your organization's unique needs, size, industry, and business objectives. It's a custom-fitted suit.

For small businesses, FinOps implementation may seem daunting initially. But the benefits are significant. Small teams can achieve better financial control and operational efficiency by optimizing cloud costs.

The ultimate goal is to maximize the value derived from your cloud investments while minimizing waste and unnecessary spending.

Imagine you're running a successful e-commerce business with ambitious growth plans. Your FinOps strategy will ensure rapid scaling of your cloud infrastructure to handle traffic spikes during peak sales periods while optimizing costs during quieter times.

On the other hand, if you're a healthcare provider, your FinOps strategy may prioritize data security, compliance, and business continuity, ensuring your cloud environment meets the strict regulatory requirements while providing reliable access to critical applications and patient data.

By tailoring your FinOps strategy to your unique needs and aligning it with your business goals, you can unlock the true potential of FinOps and drive tangible results for your organization.

Follow the best practices

While implementing FinOps, you need to improve and adapt constantly. As your cloud usage and business needs evolve, your FinOps practices should evolve.

As you begin your FinOps initiatives, some tried-and-true best practices can help ensure a successful FinOps implementation.

We've already established the importance of a culture of collaboration and shared responsibility. FinOps is a combined effort. The stakeholders must participate and be on the same page. Encourage open communication and data sharing, and ensure everyone understands the FinOps principles and goals.

Another best practice is to start small and scale gradually. Rather than attempting to overhaul your entire cloud environment overnight, begin with a pilot project or a specific workload. This approach allows you to test your FinOps strategies, learn from mistakes, and refine your processes before expanding to large-scale plans.

Automate repetitive tasks. Use tools and scripts to automate resource provisioning, decommissioning, and policy enforcement. You can reduce the risk of human error, improve efficiency, and free up valuable time for more strategic activities.

Regularly reviewing and optimizing your cloud usage is crucial. As your business needs change, you may find that some resources are underutilized or no longer necessary. Continuously monitor, adjust, and decommission the resources you don't need and save.

Challenges and pitfalls are inevitable, no matter how fool-proof your FinOps journey might be. Common challenges include resistance to change, siloed data and processes, or difficulty in accurately attributing costs to specific business units or projects.

Anticipating and proactively addressing these challenges can help you implement FinOps smoothly. As new technologies and best practices emerge, reevaluate and refine your FinOps strategies.

Regularly review your processes, celebrate successes, and learn from setbacks – this mindset will help you stay ahead of the curve and maximize the value of your cloud investments over time.

FinOps tools and their importance

What are FinOps tools?

You need proper tools to implement your FinOps strategies effectively. The market is filled with a wide range of tools and solutions. They are designed to assist you with various aspects of cloud financial management, from cost monitoring and reporting to optimization and automation.

Most FinOps tools provide cost visibility and reporting capabilities. They allow you to track your cloud spending, identify cost drivers, and generate insights for better decision-making.

As your FinOps initiatives grow, you'll need more advanced tools that offer features such as cost allocation, budgeting, and showback/chargeback functionality.

Optimization tools are another critical component of a FinOps toolkit. These solutions analyze your cloud environment, identify inefficiencies and waste, and recommend you for rightsizing resources or implementing cost-saving measures. Some tools even offer automated optimization capabilities.

Automation tools are becoming essential for FinOps teams rapidly. They allow teams to automate resource provisioning, decommissioning, and policy enforcement. They reduce manual effort and minimize human error, improving operational efficiency and cost management.

When selecting FinOps tools, it's crucial to consider your organization's specific requirements, existing tech stack, and integrations needed with other systems. A tool that excels in one area may fall short in others, so carefully evaluating your options is essential to ensure you have the right tools for your FinOps journey.

How do top FinOps tools compare?

The FinOps tools market is rapidly evolving, with new players and solutions emerging regularly. While a comprehensive comparison of all available tools can be a separate guide, let's explore some popular options, their strengths, and limitations.

Cloud provider-native tools like AWS Cost Explorer, Azure Cost Management, and Google Cloud Billing, offer basic cost monitoring and reporting capabilities. These tools are often user-friendly and seamlessly integrated with the respective cloud provider's ecosystem. They may lack advanced features like cost allocation, optimization recommendations, and multi-cloud support.

Third-party FinOps tools like CloudHealth, Cloudability, and Apptio Cloudlgenius provide more comprehensive cloud financial management capabilities. These tools offer cost reporting, showback/chargeback functionality, and optimization recommendations across multiple cloud providers. On the flip side, they can be more expensive and may require additional integration efforts.

Open-source solutions like Kubecost, Finops.co, and Cloud Custodian offer cost monitoring and optimization capabilities at no licensing cost. While these tools can be highly customizable, they require more technical expertise to set up and maintain. They may lack some of the advanced features found in commercial offerings.

When evaluating FinOps tools, consider factors such as ease of use, integration capabilities, scalability, and the level of support.

For organizations with complex multi-cloud environments or specific compliance requirements, tools like Cloudability or Apptio Cloudlgenius may be more suitable, offering advanced features and enterprise-grade support.

Smaller organizations or those with more straightforward cloud environments can use cloud provider-native tools or open-source solutions like Kubecost or Finops.co.

Why should you integrate these tools into FinOps practices?

Installing FinOps tools is just the first step. Proper tool configuration and data integration ensure accurate and reliable information flows between your FinOps tools and other systems.

Start by mapping your existing processes and identifying potential integration points for your FinOps tools. It involves integrating them with your cloud provider's billing and usage data and other systems like project management tools, ticketing systems, or financial applications.

Once the integrations are in place, establish clear processes and workflows for using the FinOps tools. It includes defining roles and responsibilities, setting up automated reporting and alerts, and establishing governance policies to manage and optimize costs.

Train all the users. Ensure that all relevant stakeholders, including finance, engineering, and business teams, are trained to use the FinOps tools effectively and interpret the data and insights they provide.

Continuously monitor and refine your FinOps tool integrations. As your cloud environment evolves and you introduce new tools or processes, prepare to adapt and optimize your FinOps tools accordingly.

By following best practices for tool integration, proper configuration, and user training, you can maximize the value derived from your FinOps tools and ensure they seamlessly support your organization's cloud financial management initiatives.

Advanced FinOps strategies

Optimize cloud spend with FinOps

Your FinOps practices will mature with time. Here's when you deploy advanced strategies to optimize cloud spend and resource allocation. These strategies are more than just cost monitoring and reporting. They help you proactively manage your cloud investments. So you can align them better with your business objectives.

One technique is cost attribution. It accurately allocates cloud costs to specific business units, projects, or applications. It provides you granular visibility into where your cloud spend is going. This way, you can better manage resource allocation and prioritization.

Cost attribution is highly valuable for organizations with complex, multi-cloud environments or those operating in a shared services model.

Another strategy is showback or chargeback models. Showback involves reporting cloud costs to individual business units or teams for visibility and accountability. And chargeback takes it a step further. It charges those units for their cloud usage.

These models create a culture of cost awareness. They push for more responsible cloud resource consumption across the organization.

Closely monitor the business value delivered by your cloud investments. You can make informed decisions about where to allocate resources and where to optimize or decommission underutilized or non-essential workloads.

We already looked at an example previously.

Take advantage of automation

Automation is a powerful enabler of FinOps success, allowing organizations to streamline processes, reduce human error, and make real-time decisions based on accurate, up-to-date data. By embracing automation in your FinOps practices, you can unlock new levels of efficiency and cost optimization.

One key area where automation can have a significant impact is cost anomaly detection. By continuously monitoring your cloud usage and cost patterns, automated systems can quickly identify and alert you to any unusual spikes or deviations from expected norms. This early detection can help you quickly investigate and mitigate potential cost overruns before they spiral out of control.

Resource provisioning and de-provisioning are also prime candidates for automation in FinOps. By leveraging automation tools and scripts, you can automatically provision or scale cloud resources based on predefined policies and triggers, such as changes in demand or utilization levels. This can help ensure that you're only paying for the resources you need, eliminating waste and optimizing costs.

Policy enforcement is another area where automation can be invaluable. By codifying your cloud governance policies and automating their enforcement, you can ensure consistent adherence to best practices across your organization. This could include automatically terminating unused or non-compliant resources, enforcing security and compliance standards, or implementing cost-saving measures like scheduling resource stop/start times.

Beyond these specific use cases, automation can bring broader benefits to your FinOps practice, such as improved efficiency, reduced human error, and faster decision-making cycles. By automating repetitive tasks and leveraging real-time data, your FinOps team can focus their efforts on higher-value activities, such as strategic planning, optimization, and driving business value.

However, it's important to approach automation in a thoughtful and controlled manner. Clearly defined policies, robust testing, and careful monitoring are essential to ensure that your automated processes are functioning as intended and not introducing unintended consequences or risks.

FinOps and its applications in different industries

The core principles of FinOps remain the same. But, the specific approaches and priorities differ across industries. Understanding these nuances will impact your FinOps practices to meet your unique needs and challenges.

For healthcare, regulatory compliance and data security are the top priority. Healthcare organizations' cloud environments must meet strict regulations like HIPAA. They should also maintain the highest levels of data protection for sensitive patient information. FinOps practices in this industry will focus on automating compliance checks, implementing robust access controls, and optimizing costs without compromising security or availability.

For e-commerce businesses, scalability and agility are the priority. During peak shopping seasons, these organizations need to rapidly provision and scale cloud resources to handle spikes in traffic. FinOps strategies for this sector will involve auto-scaling policies and rightsizing resources based on demand patterns. It'll also include deploying serverless or containerized architectures for maximum flexibility.

In the finance sector, data integrity and business continuity are critical. Financial institutions want their cloud environments to be highly available, resilient, and capable of processing transactions with utmost accuracy and reliability. FinOps practices in this industry will prioritize disaster recovery planning, implementing multi-region redundancy, and optimizing costs while maintaining strict service level agreements (SLAs).

Manufacturing companies, on the other hand, focus on integrating their cloud environments with industrial systems, such as Internet of Things (IoT) devices and operational technology (OT) networks. So, they can have cost allocation models that allocate cloud costs to specific production lines or facilities and implement edge computing architectures to reduce data transfer costs.

No matter what the industry is, an effective FinOps strategy requires a deep understanding of the sector's unique challenges, regulatory landscape, and business objectives.

By tailoring your FinOps practices to these considerations, you can unlock the full potential of cloud cost optimization while ensuring compliance, security, and alignment with your industry-specific goals.

FinOps is critical for organizations wanting to optimize their cloud costs, enhance visibility, and maximize the business value of their cloud investments.

As cloud adoption continues to accelerate, the importance of FinOps will only grow. By starting your FinOps journey today and embedding these practices into your organization, you can stay ahead of the curve and position yourself for long-term success in the ever-evolving cloud landscape.

Ready to embark on your FinOps journey? Arche is here to help.

Book a personalized FinOps consultation with our experts today. Our team will work closely with you to understand your unique requirements, assess your current cloud environment, and develop a tailored FinOps strategy that aligns with your business goals and drives tangible results.

Don't let cloud costs hold your organization back. Contact Arche AI and unlock the full potential of FinOps.

Pioneer cloud wayfinder Rohit captains enterprise transformations, architecting accelerated futures through landmark migratory voyages plotted for industry titans. His prowess in manifesting bespoke solutions and commitment to insurance and banking partners stretches back years, navigating the cosmos’ shifts as Microsoft’s emissary. Cognizant hallmarks, VMWare certifications, and acclaimed IT transformations now guide the path to grander horizons at Netcon.

Partner with us

Unlock your business potential with our committed team driving your success.

Read these next

Data Center

Mastering Data Center Management with Expert Consulting

By leveraging the knowledge and experience of seasoned professionals, organizations can transform their data centers from cost centers into strategic assets that drive business growth.

Read now ➝

Data Center

Engaging with Data Center Consultants for Optimal Solutions

From improving energy efficiency and reducing operating costs to enhancing security and planning for future growth, the right consultant can unlock opportunities that drive business value.

Read now ➝

Data Center

Introduction to Data Center Certifications: An Overview

For both data center professionals and the facilities they manage, the lack of industry-recognized certifications can cause a chain reaction of problems. We solve the pain in this blog.

Read now ➝

Ready to take your company to the next level?

Transformation starts here, talk to our experts

© Copyright 2024 Arche AI Pvt. Ltd.

Ready to take your company to the next level?

Transformation starts here, talk to our experts

© Copyright 2024 Arche AI Pvt. Ltd.